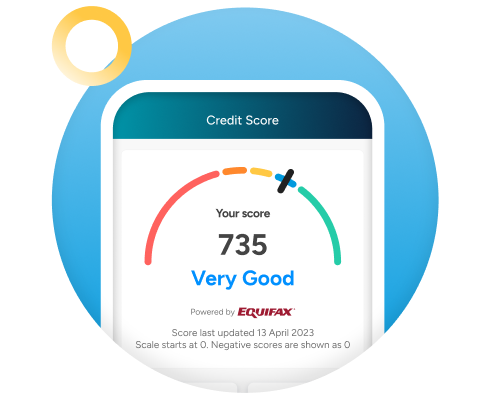

Now you will be able to check your credit score on the go. What’s more, you’ll be able to see what’s impacting your score, as well as tips to help you improve.

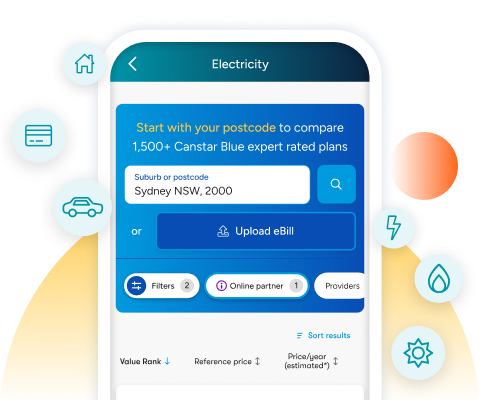

Compare products from 17 different finance and household expense categories and see if you could be getting a better deal on things like energy, phone plans, loans, credit cards and much more.

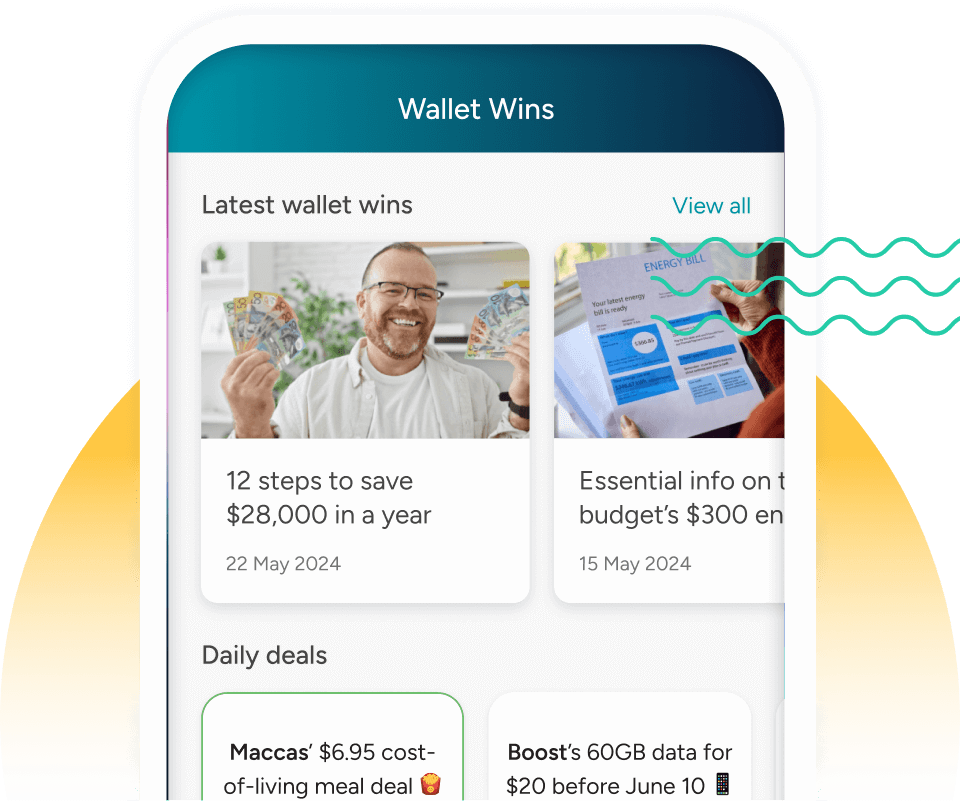

Receive tips and offers to help you save and improve your product knowledge and financial literacy skills.

Get access to a wide range of App-only offers, promotions and giveaways on anything from tech, appliances and subscriptions.

Have been relying on Canstar for years initially to research bank loan rates and this helped me talk confidently either to new lenders or to negotiate better rates with existing lenders.

Love this tool – super easy to use, and great to get an instant snapshot of your credit rating.

Simply download the Canstar App from the Google Play or App store.

Option 1: You can click ‘Register with Email’ when you open the app, then enter your email address and create a password.

Option 2: If you are a Google user, you can click ‘Continue with Google’ and sign up using your Google account.

Option 3: If you are an Apple user, you can click ‘Continue with Apple’ and sign up using your Apple account.

As the Canstar Mobile App and Canstar Web Accounts are synced, the details you use to sign up for the Canstar Mobile App are also the details you use to log in to other Canstar tools on the website like the Free Credit Score.

I already have a Canstar Mobile App account and NOT a Canstar Website Account. How do I log in to the updated app?

Visit the Google Play or Apple Store to update the app (which will download the new version) and log in with the same details you have always used. These details can also be used as your Canstar Web Account login details.

I already have a Canstar Mobile App account AS WELL AS a Canstar Website Account. How do I log in to the updated app?

Visit the Google Play or Apple Store to update the app (which will download the new version). Your Canstar Web Account login details have now become your Canstar Mobile App login details.

With our recent app update, we have streamlined the login process for our customers. You will now seamlessly access both your Canstar Web Account and your Canstar Mobile App by using your Web Account details. You will no longer be able to use the password you previously used to log in to the Canstar App.

If you wish to change your password, you can do so by clicking ‘forgot password’ in either the Canstar App login page or the login page for canstar.com.au and following the prompts.

I already have a Canstar Website Account and NOT a Canstar Mobile App account. How do I log in to the app?

If you already have a Canstar Web Account, you will use these same details to log in to the Canstar Mobile App.

Canstar’s credit tool is a soft credit check and not a full credit report. A full credit report can be done through credit bureau providers such as Equifax, which can be found here.

Your credit score may be different with another company if they use a different credit bureau provider.

Canstar uses Equifax but if a company uses a different provider they will likely use a different scoring system. This means they will take different factors into account when computing the score so it will never be the exact same.

Another possibility is if there was a missed payment or application being submitted between the time of checking the two scores.

If your credit score leads you to suspect there is an error or suspicious activity with your credit, we suggest reaching out to Canstar’s credit bureau provider Equifax here for assistance.

Step 1: Download the Canstar App.

Step 2: Log in or create a free Canstar account via our Canstar App

Step 3: Hit ‘Enter the draw’.

Now you’re in the draw to win!

^Subject to the terms and conditions laid out here.

To the extent that any content in the Canstar App constitutes general financial advice or credit information, it is provided by Canstar, not Canstar Blue.