With the current cost of living squeezing household budgets to the max, it appears many Aussies are cutting costs by downgrading their NBN plan. According to data released by Australia’s biggest consumer watchdog, thousands of homes have dropped down to slower, less expensive broadband plans in the last quarter — indicating that many of us are picking affordability over lightning-fast speeds.

The Australian Competition and Consumer Commission (ACCC) has published its NBN Wholesale Market Indicators Report for the March 2023 quarter, looking at the trends and movements in the wholesale NBN space. The report analyses the wholesale residential and business services purchased by internet providers from NBN Co, and provides insights into each quarter’s most in-demand plans and retailers.

Customers move to cheaper plans as belts tighten

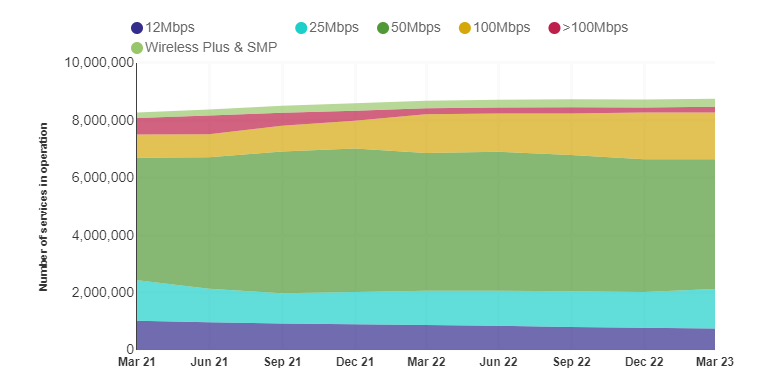

While recent reports have shown customers flocking to faster speed tiers, the ACCC’s March data shows a considerable decrease in active services with speeds of 50 megabits per second (Mbps) or faster. The 50Mbps speed tier still accounts for 52% of the NBN market, but has fallen by 2.1% in the past three months — thanks to almost one hundred thousand customers cancelling their plan or switching to a different speed.

Of course, not all of those customers moved to a cheaper speed tier, as very fast services of 250Mbps or more also increased this quarter. But the ACCC has charted a significant uptick in plans on the 25Mbps tier, with 125,000 new services activated in the December 2022 — March 2023 period.

The NBN 25 speed tier now accounts for around 1.4 million services in the wholesale market, or 16%. While it’s not the cheapest option available to consumers, it may be a ‘just right’ choice for homes looking to balance a decent performance with an affordable monthly bill.

The ACCC has speculated many customers previously on NBN 50 plans decided to switch to a cheaper tier after internet providers ceased offering introductory new-customer discounts on faster plans. NBN 50 prices tend to start at around $65 per month undiscounted, although promo offers can lower this cost to as little as $55 for a limited time (usually six months).

Moving to an NBN 25 plan can save customers anywhere from $10 to $30 per month, depending on the plan and provider, with prices starting at around $55-$60 monthly on the lower end of the scale. As most NBN providers offers plans without lock-in contracts, there’s plenty of wiggle room for households to switch speeds if their circumstances change.

If you are looking to cut broadband costs, we’ve compiled some of the cheapest unlimited NBN 25 plans on our database below.

The following table shows a selection of published NBN 25 plans on Canstar Blue’s database, listed in order of standard monthly cost, from the lowest to highest, and then by alphabetical order of provider. Use our comparison tool to see plans from a range of other providers. This is a selection of products with links to a referral partner.

Aussies ditch big three for smaller telcos

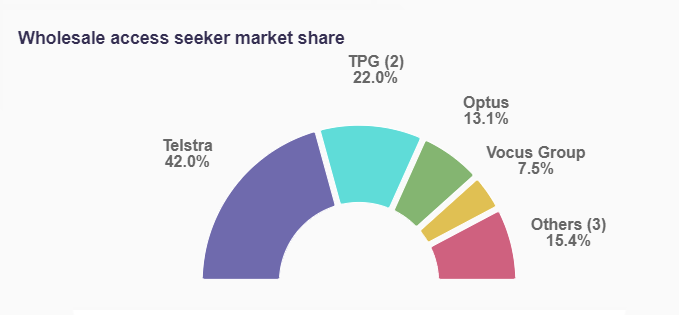

The increased market share of smaller, competitively-priced telcos also indicates a move to cheaper deals. The ACCC recorded that Telstra, TPG and Optus each lost market share in the March quarter, collectively losing 58,000 services. While these brands still dominate the NBN market, lesser-known names are gaining ground: Vocus (Dodo and iPrimus) grew by 33,000 services, while other smaller telcos — such as Aussie Broadband, Southern Phone and Superloop — collectively acquired close to 52,000 services.

These small telcos now account for 15.4% of the wholesale market share, up from 14.9% in the last quarter. Vocus’ market share jumped to 7.5% from 7.2% in the three-month period, while Telstra and TPG each dropped 0.4% (to 44% and 22% respectively), and Optus remained stable at 13.1%.

While it’s not quite a mass exodus, it’s clear that many customers are now exploring options outside of the biggest providers.

“The growing competition in the broadband market is good news for consumers as it encourages more choice and competitive pricing for internet services,” ACCC Commissioner Anna Brakey said.

“We have seen sustained market growth quarter on quarter among the smaller broadband providers, reinforcing their presence in the market and the continued demand from consumers for alternative service offerings.”

If you’re interested in seeing how these smaller names stack up, you can compare NBN 50 plans below.

The following table shows a selection of published NBN 50 plans on Canstar Blue’s database, listed in order of standard monthly cost, from the lowest to highest, and then by alphabetical order of provider. Use our comparison tool to see plans from a range of other providers. This is a selection of products with links to a referral partner.

Super-fast NBN still in demand, but satellite losing ground

NBN 50 is still the most popular speed pick for Aussies, but ongoing NBN technology upgrades mean more homes can now access super-fast NBN 250 and NBN 1000. The ACCC found that around 45,000 new services were activated on faster Fibre to the Premises connections, while numbers on slower Fibre to the Node and Fibre to the Building connections dropped.

The combination of availability and customer discounts has led to an increase in extra-fast NBN services, with over 24,500 new plans with speeds of 250Mbps and up added in the March quarter. However, previous reports indicate that many customers on super-fast NBN plans only stick around for the discounted period; once monthly prices rise, it’s possible that households will again drop down to slower, but cheaper speed tiers.

Regional customers are also looking for more reliable services, with services on NBN’s Sky Muster satellite declining by almost 6,000 in the March quarter. Some of these customers may have moved on to NBN fixed wireless plans, which are increasingly available in rural areas, and grew in number by around 1,700 services compared to the December period.

However, there’s also increased competition in the satellite space thanks to Space X’s Starlink service, which promises faster speeds and better reliability (albeit with much higher prices).

Share this article