QuickBooks Online Accounting Software Review

One of the world’s largest accounting software companies, Intuit has been going strong since 1983, changing with the market to provide businesses and owners with accounting solutions that power prosperity around the globe. One of these solutions is its cloud-based software – QuickBooks Online – which was developed in 2000 and has become a mainstay within the accounting software market. Offering multiple plans and features, what should you be considering when looking at QuickBooks Online accounting software? Find out with this Canstar Blue review.

QuickBooks Online Accounting Software

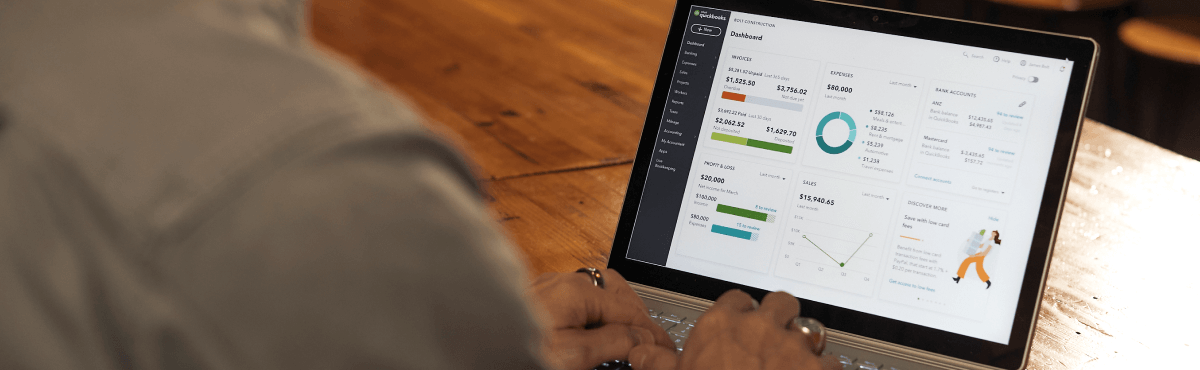

Intuit offers QuickBooks Online as its flagship product, in addition to its Timesheets app. QuickBooks Online is a cloud-based accounting software suite targeted towards small businesses, and comes with a 30-day free trial, 24/7 support, and automatic backups (so there’s no risk of losing your business’s data). There are several product versions that each include a different range of features and prices, allowing you to find the best fit for your needs.

QuickBooks Online features and plans

QuickBooks Online features a number of accounting tools within its program, from invoicing to payroll, GST and BAS document prep, cash flow management through to reporting and insights. What features you’ll have access to will depend on which plan you sign up to, with the larger plans coming with more features. QuickBooks Online is split into four plans – Simple Start, Essentials, Plus and Advanced with the costs and features listed below.

QuickBooks Online Simple Start

Priced at $29 per month, the QuickBooks Online Simple Start plan allows you to:

- Track income and expenses

- Send unlimited invoices and quotes

- Snap and store receipts

- Track kilometres

- Connect your bank accounts

- Track GST and e-lodge BAS

- Review insights and reports

- Manage cash flow

QuickBooks Online Essentials

Priced at $45 per month, the QuickBooks Time Essentials plan allows you to do everything in the Simple Start plan, as well as:

- Manage suppliers and bills

- Deal with multi-currency transactions

- Set-up recurring transactions

- Manage up to three users

QuickBooks Online Plus

Priced at $60 per month, the QuickBooks Plus plan allows you to do everything in the Essentials plan, as well as:

- Track inventory

- Track projects and location

- Manage budgets

- Manage up to five users

QuickBooks Online Advanced

Priced at $110 per month, the QuickBooks Advanced plan allows you to do everything in the Plus plan, as well as:

- Automate workflow

- Data sync with Excel

- Use custom reporting fields

- Customise dashboards

- Customise role permissions

- Backup and restore data

- Manage employee expenses

- Manage revenue recognition

- Manage up to 25 users

QuickBooks Online is also accessible on any device, including phone, tablets and computers, and as it’s a cloud-based program, you don’t need to have installed anything on your device of choice, just remember your login details! QuickBooks Online can also integrate with other apps such as PayPal, Shopify and Square to help your business keep the money flowing to where it needs to be.

|

Online accounting software for small businesses with up to 4 employees

|

from $3.00/month min. cost $29.00 $3.00 over 1 month |

Go to site |

|

Accounting Software for Small Businesses to manage suppliers and multiple users

|

from $4.00/month min. cost $45.00 $4.00 over 1 month |

Go to site |

|

Accounting Software with project and inventory tracking for Small Businesses

|

from $6.00/month min. cost $60.00 $6.00 over 1 month |

Go to site |

|

Accounting Software with project and inventory tracking for Small Businesses

|

from $33.00/month min. cost $110.00 $33.00 over 1 month |

Go to site |

QuickBooks Online

Formerly known as TSheets, the QuickBooks Time focusses on project management and tracking, as well as helping to cover other areas such as shift scheduling and submitting timesheets. There are two plans available, including the Premium plan, which includes:

- One admin user

- Time-tracking

- Payroll and invoicing

- Job and shift scheduling

- Real-time reports

- Time-off management

- Photo attachments

- Time clock kiosk with photo capture

The Premium plan costs $8 per month, while the Elite costs $10 per month, and comes with additional features, such as:

- Track project progress

- Project estimates vs. actuals

- Project activity feed

- Timesheet signatures

- Geofencing technology.

Both plans also incur a $25 per month base fee, but also come with customer support, set-up assistance and a standalone app to help you keep your jobs in the one spot.

Does QuickBooks Time have a free trial?

Currently QuickBooks offers a 30-day free trial on most of its products and plans, including its Timesheets app.

Other articles you may be interested in:

Should I use QuickBooks Online accounting software?

QuickBooks Online is one of the more competitively priced accounting software programs available, and offers a number of plans and options for small to medium business owners and operators. With award-winning customer support on all plans, and the ability to cancel anytime, QuickBooks Online is a worthwhile option for many businesses. However, with tiered pricing plans, you’ll have to look closely at what features your business really needs.

While accounting software can help take the stress out of invoicing and timesheets, it’s worth looking into what’s available before signing on the dotted line for a plan, as you don’t want to be paying for something that isn’t suited to your needs. To help you find the best fit, check out our ratings on accounting software programs to and compare today.

About the author of this page

Dean Heckscher was a content producer and editor at Canstar Blue for more than five years until 2024, most recently as the Site Editor. He holds dual Bachelor degrees in Business and Creative and Professional Writing from the Queensland University of Technology.