The Australian Competition and Consumer Commission (ACCC) has released full details on proposed variations to broadband pricing submitted by NBN Co that, if approved, could cause internet bills to double over the next decade.

NBN Co has asked for changes to the Special Access Undertaking (SAU), which regulates how internet providers can access and sell NBN services to residential and business customers. The proposed reforms cover changes to the existing NBN Co pricing model, which if implemented may see NBN access costs continue to rise each year until the SAU’s expiry in 2040.

NBN Co’s proposal: what to expect

The ACCC previously accepted NBN Co’s SAU in 2013, when the broadband network was still very much in its infancy and focused on fibre, wireless and satellite connections. With the initial NBN rollout now complete, and additional copper-based technologies comprising a significant amount of current NBN connections, NBN Co is seeking to create a single framework of regulations to cover the entire network.

However, NBN Co’s proposal also includes some changes to wholesale pricing, which the ACCC has warned could lead to a “narrowing” of reasonably-priced plans as well as a push to move customers to faster services at higher prices.

Some of the key SAU reforms requested by NBN Co include:

- Extend the scope of the SAU to cover all NBN network technologies, including fixed line, fixed wireless, and satellite

- Zero-rating the connectivity virtual circuit (CVC) charge on higher-speed services of 100Mbps or faster, so retailers can access these products for a fixed monthly cost

- Introducing bundled access and CVC offers for lower speed tiers, with a CVC overage charge of $8 per Mbps, per month

- Changes in entry-level pricing to bring NBN 25 plans closer in alignment to NBN 12

- Adding a new 12Mbps voice-only plan for $12 per month

NBN Co has also proposed an initial price increase on NBN 25 services, in exchange for faster upload speeds (10Mbps, up from 5Mbps). The current entry-level NBN 12 plan would remain available to retailers, but a new voice-only option would also be launched, with a proposed price of $12 per month.

How will NBN prices change?

Currently, NBN providers pay a variable CVC charge to cover the amount of bandwidth that can be offered to customers. The more CVC a provider buys, the more network capacity it can provide, meaning customers will experience less congestion and better speeds. Internet providers have long been lobbying to kill off the CVC model in favour of a fixed price per NBN service, but it seems NBN Co’s counter-offer will seek to regain lost CVC revenue by steadily charging higher wholesale prices for the most popular speed tiers.

While changing to a simpler, flat-rate monthly cost for high-speed services sounds good on paper, currently less than 20% of residential NBN users are on plans in this category. The vast majority of Australians prefer slower speed tiers, with 58% of homes on NBN 50 plans as of March 2022. Unfortunately, the ACCC believes it’s these customers that will be among the hardest hit by NBN Co’s proposed pricing model.

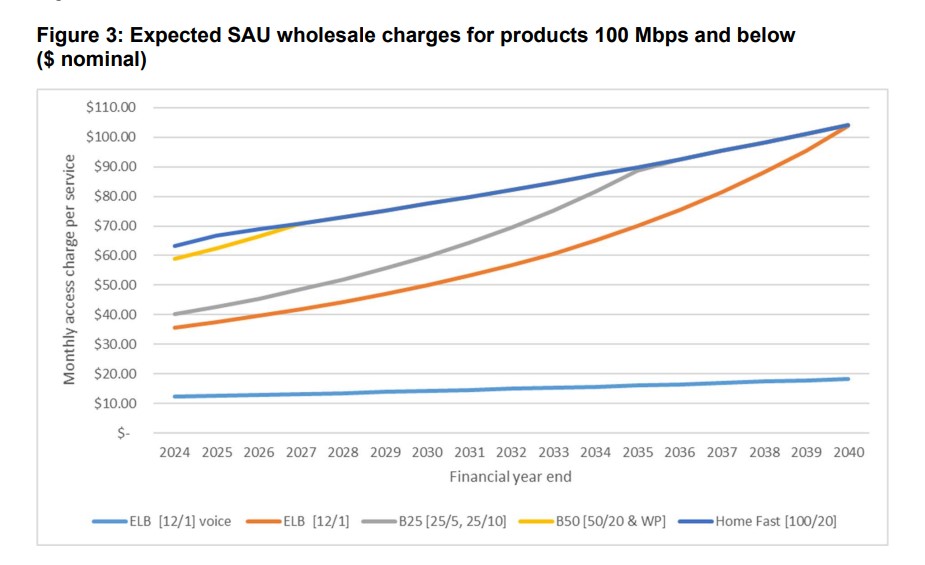

The ACCC predicts that wholesale charges for plans up to 100Mbps will rise, leading to retailers effectively paying the same costs for NBN 50 and NBN 100 plans within the next few years. This will in turn push customers on to faster speed tiers, regardless of their actual speed and usage requirements — meaning homes and businesses will likely be paying more for services they don’t need.

While the the ACCC acknowledged that it is difficult to predict exact price increases, its consultation paper covering the proposed changes states that “applying NBN Co’s current forecasts the maximum allowable cost to retailers to acquire the entry-level speed tier would double by around 2033, and continue to increase towards $104 per month in nominal terms by 2040.”

The ACCC has cited figures from the Bureau of Communications and Arts Research as a key reason why a migration to fast and extra-fast plans may be unnecessary for many Australian homes. According to the Bureau’s forecasts, the median household speed requirement in 2028 will be just 29Mbps, and 99.9% of homes won’t need speeds faster than 78Mbps.

While NBN Co is unable to provide detailed commentary on the ACCC’s analysis, due to the post-election transition to new shareholder ministers, the network stated that it welcomes the commencement of the ACCC’s consultation process.

“Our proposed SAU variation responds to RSP calls for changes to our price construct, and the need for greater regulatory and price predictability,” said an NBN Co spokesperson.

“We look forward to an ongoing discussion, as part of this consultation process, with the ACCC and the industry.”

Big three telcos: NBN Co proposal ‘disappointing’

Unsurprisingly, Australia’s three biggest telcos have hit back against NBN Co’s proposed changes, collectively calling for a model that would put customers first and keep broadband affordable for all families.

Andrew Sheridan, Optus’ Vice President of Regulatory and Public Affairs, stated that these SAU reforms would “hit everyone’s hip pocket” and called on the new Labor Government to step in.

“Retail providers like Optus will have no choice but to pass proposed cost increases onto our customers, knowing that many are already feeling the pain of rising household costs,” Mr. Sheridan said.

“The new Government has an opportunity to refocus NBN Co’s priorities towards its core objective of ensuring all Australians have access to fast broadband, at affordable prices, and at least cost.”

Similarly, a Telstra spokesperson told Canstar Blue that NBN Co’s SAU “failed to deliver” on what was needed to secure Australia’s digital future, and also asked for Government intervention.

“The time has clearly come for the ACCC to define a way forward that delivers more certainty for the market, better wholesale prices and services for customers and sustainable returns for retailers.

“We believe there is also an opportunity for government to play a role here, with the policy focus being on encouraging take up through affordability and innovation rather than historic cost recovery.”

TPG Telecom, which includes TPG, Vodafone, iiNet, Internode and Westnet, had perhaps the harshest response, with a company spokesperson calling the proposed price model convoluted.

“This proposal will effectively make entry level broadband in Australia a thing of the past and is a slap in the face for those who rely on affordable broadband to stay connected for work, study and play,” the spokesperson said.

“The NBN’s pricing proposal can be summed up as price hikes and no improvements.”

Related: How to save money on your internet bill

Lower costs key to retaining NBN customers

While Telstra has singled out NBN’s wholesale prices as the world’s highest among comparable countries, an NBN-commissioned 2021 study placed Australian broadband as the sixth most affordable out of 13 OECD countries between FY18 and FY20.

The report also found that Australians spent roughly 1.1% of their income on NBN services — less than what we’re typically spending on water or energy — and that only one in eight survey respondents considered the NBN ‘unaffordable’.

However, the current pricing of NBN products has already driven many customers to look for cheaper and more reliable alternatives, and NBN Co is forecasting more than 260,000 customers will switch to 4G and 5G wireless broadband in the 2022 financial year. NBN service providers are also promoting 5G home internet as coverage increases, with TPG Telecom brands in particular revising their 5G broadband products this week to offer prices comparatively lower than high-speed NBN.

If NBN Co wants to retain customers, and ensure the long-term success of the network, keeping wholesale costs affordable will help drive competition among retailers. This will lead to more broadband options for homes and businesses, and better pricing for what is now an essential service for the majority of Australians.

Currently, NBN Co’s requested SAU changes aren’t locked in, and the ACCC will consult on the proposal before making a final decision. The ACCC is accepting feedback on the matter until July 8, 2022.

Compare NBN plans

Unlimited NBN 100 Plans

The following table shows a selection of published unlimited NBN 100 plans on Canstar Blue’s database, listed in order of standard monthly cost, from the lowest to highest, and then by alphabetical order of provider. Use our comparison tool above to see plans from a range of other providers. This is a selection of products with links to referral partners.

Unlimited NBN 50 Plans

The following table shows a selection of published unlimited NBN 50 plans on Canstar Blue’s database, listed in order of standard monthly cost, from lowest to highest, and then by alphabetical order of provider. Use our comparison tool above to see plans from a range of other providers. This is a selection of products with links to referral partners.

Unlimited NBN 25 Plans

The following table shows a selection of published unlimited NBN 25 plans on Canstar Blue’s database, listed in order of standard monthly cost, from the lowest to highest, and then by alphabetical order of provider. Use our comparison tool above to see plans from a range of other providers. This is a selection of products with links to referral partners.

Unlimited NBN 12 Plans

The following table shows a selection of published unlimited NBN 12 plans on Canstar Blue’s database, listed in order of standard monthly cost, from the lowest to highest, and then by alphabetical order of provider. Use our comparison tool above to see plans from a range of other providers. This is a selection of products with links to referral partners.

Share this article