MYOB Accounting Software Review

The world of accounting software can be a difficult one to navigate, with no shortage of options available for business owners to choose from. But as with running a business, you’ll want accounting software that’s easy to use and keep on top of, as well as offering plenty of benefits that allow you to have more spare time for yourself.

If you’re looking to find the right accounting software for your business, read on to find out more about MYOB in this Canstar Blue guide.

What is MYOB?

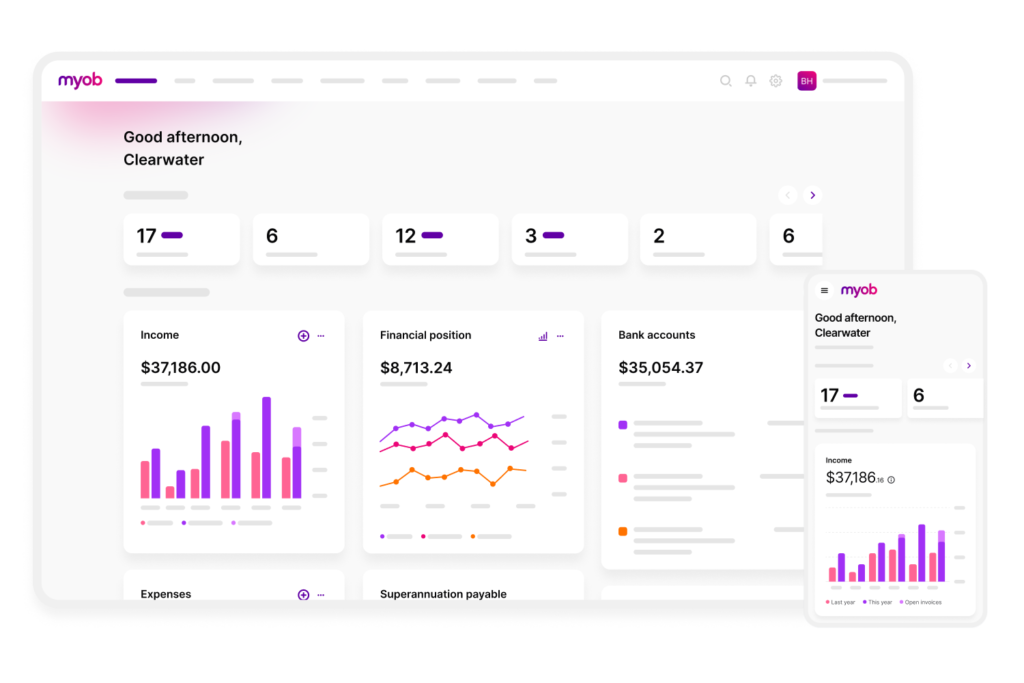

MYOB is a leading business management solution with a core purpose of helping more businesses in Australia and New Zealand start, survive and succeed. MYOB delivers end-to-end business, financial and accounting solutions direct to businesses employing between 0 and 1000 employees, alongside a network of accountants, bookkeepers and consultants.

MYOB accounting software

MYOB offers a range of plans tailored to suit businesses of all shapes and sizes – from sole operators to teams in the hundreds. It’s designed to put your admin on autopilot, give you a clear view of cashflow and help you stay confidently compliant – so you can spend less time buried in the books and more time driving your business forward.

Take MYOB even further by connecting it with the tools you already use. The MYOB App Marketplace gives you access to a wide range of third-party integrations – Whether you are running your eCommerce store through Shopify, utilsing Square’s POS system or syncing Bunnings invoices straight into MYOB via PowerPass. If there’s a job to do, there’s likely an integration to help you do it faster.

What features does MYOB offer?

The following features are available in select MYOB small business accounting plans.

- Quotes and invoices

- Employee benefits

- Employee self-onboarding

- Track income and unlimited expenses

- Scan and store receipts

- Connected bank accounts

- Track GST and lodge BAS

- Insights and reporting

- Inventory management

- Payroll

- Mobile app

Additional features on the more extensive (or premium) plans include:

- Unlimited payroll

- Unlimited inventory

- Time billing

- Job tracking

- Multi-currency

- Advanced reports and insights

Check the individual plans below to see what’s included.

|

For sole traders and small businesses with up to 2 employees.

|

From $34.00/month min. cost $34.00 |

Go to site |

|

For small to medium businesses with multiple employees.

|

$63.00/month min. cost $63.00 |

Go to site |

|

For established businesses needing to fast track pay runs and inventory.

|

$75.00/month min. cost $75.00 |

Go to site |

|

For complex businesses managing multiple locations, jobs or currencies.

|

$97.50/month min. cost $97.50 |

Go to site |

|

For businesses that need standalone payroll for up to 4 employees

|

$9.00/2 years min. cost $9.00 |

Go to site |

|

The all-in-one mobile app for sole operators, freelancers, and the self-employed.

|

$12.00/year min. cost $12.00 |

Go to site |

What plans does MYOB offer?

Solo by MYOB Plan

Solo by MYOB is a new business admin app designed exclusively for sole operators in Australia. The app features include invoicing, payments, expense tracking, and ATO-ready record keeping, with more set to be delivered across 2025.

MYOB Lite Plan

Step up from spreadsheets with a powerful, yet simple, accounting solution. Lite is ideal for growing businesses with up to two employees at $2/month per employee, including GST.

MYOB Pro Plan

Scale up your operations by unlocking additional features available in Pro like unlimited payroll ($2/month per employee), unlimited bank connections and timesheets.

MYOB AccountRight Plus and Premier Plans

Comprehensive plans to support large, established businesses. The full-featured plan includes unlimited payroll at no extra charge, unlimited inventory, time billing and rostering. Upgrade to Premier to access multi-currency trading and multi-location inventory tracking.

MYOB Payroll Only Plan

Just need a hand with payroll? The MYOB Business Payroll Only plan has you covered for up to 4 employees. Includes all the same payroll features as the full plans, like automated payroll and STP reporting, digital onboarding, and access to Flare, the employee benefits platform.

MYOB plan add-ons

As your business grows, MYOB grows with you. Add-ons like Payroll, Inventory, Online Payments and financial solutions let you customise your software to suit your setup without needing to switch platforms. You only pay for what you need, when you need it, giving you the flexibility to build the right tools around your business and the confidence to scale on your own terms.

- Inventory upgrade – Lite and Pro users can upgrade to unlimited inventory for $22/month.

- Online Payments – give your customers more ways to pay, like through AMEX, Apple Pay™, BPAY, Google Pay™, Mastercard, PayPal, and VISA.

- Invoice financing – access funds from your client’s unpaid invoices through invoice financing with Butn*. Apply for invoice finance from within your MYOB account (terms and conditions apply).

Does MYOB offer a free trial?

Head to MYOB’s website to check out the latest offers and trials available to new and returning customers.

Should I use MYOB accounting software?

MYOB has been a long-standing name within the Australian accounting software scene, offering a number of plans, features and compatible add-ons for businesses to choose from and utilise. With a number of apps also available to download and use on-the-go, MYOB may be a suitable option regardless of what type of business you operate. In comparison to other brands however, MYOB may be on the more expensive side, particularly its plans aimed at larger businesses. Although with the inclusion of business management features, MYOB could be worth exploring if you’re looking to do more than just the books.

It may be a small price to pay for some peace of mind when it comes to the financial side of your business, as the numbers can quickly become overwhelming. At the end of the day, it’s always recommended to look into all of your options, as you may find a particular accounting software fits with your current business setup or schedule better than others.

About the author of this page

Rachel Bollerman is a Content Producer on Canstar Blue’s editorial team. Rachel writes articles across consumer, streaming, utilities and energy verticals. After graduating with a Bachelor of Communications, majoring in Journalism at the Queensland University of Technology, Rachel has worked in a variety of public relations, marketing and communications roles. She has experience in community management, social media marketing, blog writing and other styles of copywriting. Prior to joining Canstar, Rachel worked at the Institute for Urban Indigenous Health where she assisted with campaign management and communications across the organisation. When she’s not working, Rachel enjoys doing arts and crafts projects at home and spending time with friends.

You can follow Rachel on LinkedIn and read more of Rachel’s published articles.