Soaring wholesale electricity prices pose a double-whammy risk to consumers, the competition watchdog has warned — higher power bills now and higher power bills into the future, as the hard-won competitiveness of Australia’s electricity market is undermined.

The Australian Competition and Consumer Commission’s (ACCC) Electricity Market Inquiry Report smashed the assumption that bigger power bills meant even bigger profits for all energy providers.

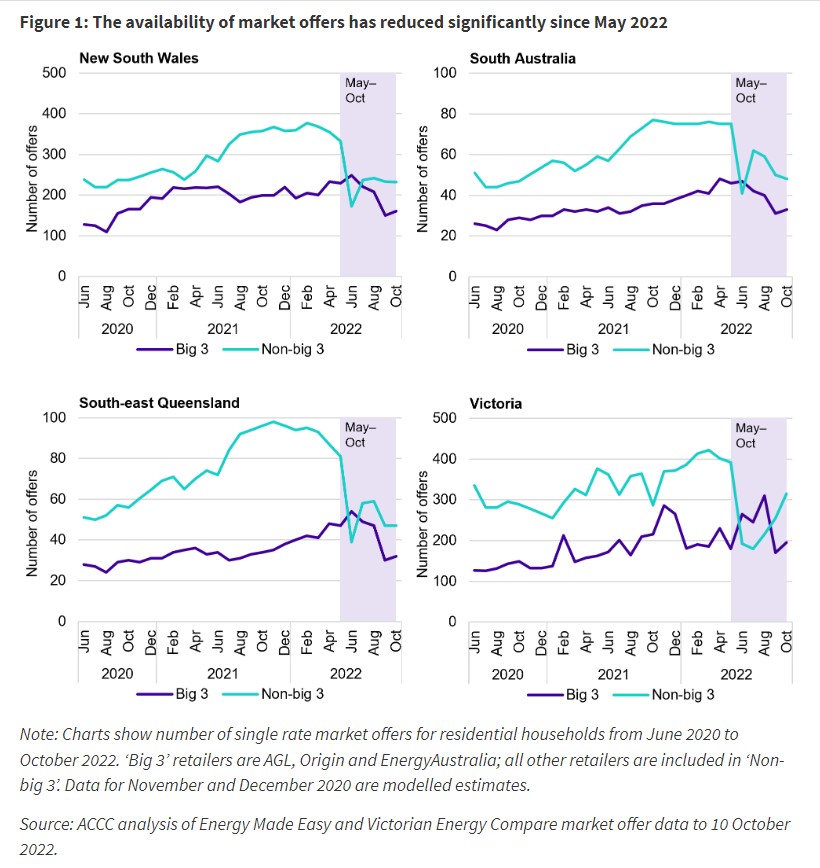

The consumer watchdog pointed out that since May 2022, six electricity retailers had folded under the pressure of wholesale price hikes, while several more had encouraged existing customers to shop around for a better deal. Other brands closed to new customers by withdrawing plans from sale until wholesale conditions stabilised.

When that stabilisation may occur is unclear. The Australian Energy Market Commission (AEMC) said last week that it would push back its annual Residential Electricity Price Trends report — which usually provides an indication of pricing to come over the following years — by about six months to mid-2023 to allow it more time to consider the energy market mayhem of 2022.

Higher wholesale prices not good news for all energy retailers

While the pain inflicted on Aussie households from surging wholesale electricity prices has been well-documented, there has been a less obvious impact on smaller electricity providers.

As the ACCC explained, many smaller retailers lost access to exchange-traded electricity hedging contracts, which are long-term fixed-price contracts between electricity retailers and generators. These contracts allow retailers to lock in prices for volumes of electricity in advance, providing them with certainty on what they’ll pay for their wholesale supply even when prices fluctuate in the real-time ‘spot’ energy markets.

The ACCC found that many small retailers had been forced onto over-the-counter hedging contracts, which also lock in future electricity supplies but at higher prices. Combined with factors including retail price caps, this has led to increased wholesale costs for retailers, and in turn, was forcing small competitors out of the market completely.

“We understand that much higher energy prices are already hurting Australian households. We’re drawing attention to the challenges facing smaller retailers, because we know if we lose retail competition everyone will pay more for electricity over the long term,” ACCC Commissioner Anna Brakey said.

“We don’t want to lose the competition gains we’ve made in recent years because increasing market concentration is in no-one’s interest, other than the big three energy companies.”

Why the gap between market and default offer prices is closing

Reduced competition meant that the price gap between market offers — the electricity plans created by retailers, which are usually more competitively priced — and default or standing offers — the plans provided by retailers at a regulated price cap — had narrowed, the ACCC said.

It estimated that the price of new market offers increased by about $300 between April and October of this year. By October, the typical range of market offers across New South Wales, Victoria, Queensland, South Australia, the Australian Capital Territory and Tasmania was within 8 percent of the default offer.

“The flow-on effect from the higher spot market and hedging contract prices has been that consumers choosing a new energy provider now have a smaller range of more expensive market offers to choose from,” the ACCC’s report said.

The report included recommendations for addressing the impact of current energy market conditions, including allowing the Australian Energy Regulator (AER) to change the regulated default offer more often than its current yearly price-setting cycle. The AER should also have the power to monitor contracts market trading between retailers and generators and make sure its default offer was set at a level that more accurately reflected the operating and hedging costs of retailers.

Still room to save on energy by switching

Despite this price-gap narrowing, the AER said last week that there was still potential for households to find a better electricity deal. Its annual market report found that bill-payers could save as much as $404 annually by switching from a default, standing, offer plan to a market offer.

If you’re looking to switch electricity plans, or just want to see how your current provider compares, check out some of the cheapest plans on offer below.

Here are some of the cheapest published deals from the retailers on our database that include a link to the retailer’s website for further details. These are products from referral partners†. These costs are based on the Ausgrid network in Sydney but prices may vary depending on your circumstances. This comparison assumes general energy usage of 3900kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision. Here are some of the cheapest published deals from the retailers on our database that include a link to the retailer’s website for further details. These are products from referral partners†. These costs are based on the Citipower network in Melbourne but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4000kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision. Here are some of the cheapest published deals from the retailers on our database that include a link to the retailer’s website for further details. These are products from referral partners†. These costs are based on the Energex network in Brisbane but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4600kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision. Here are some of the cheapest published deals from the retailers on our database that include a link to the retailer’s website for further details. These are products from referral partners†. These costs are based on the SA Power network in Adelaide but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4000kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

Share this article