KEY POINTS

- Energy credit checks are run by retailers for post-paid plans to ensure customers can pay their bills on time.

- Prepaid energy plans bypass the need for a credit check, but only one retailer offers them at the time of writing.

- Failing a credit check heightens your risk of rejection from other providers, but your existing provider is obligated to give you access to a standing offer.

Practically all energy companies are entitled under their terms to carry out credit risk assessments for new customers signing up for an electricity or gas market offer. If you’re alarmed by the idea of an energy company collecting your credit information, find out below which companies carry out credit checks, what information they collect and what they’re allowed to do with it.

On this page:

- What is a credit score?

- Why do energy companies run credit checks?

- What credit information do energy providers collect?

- What do energy companies do with credit information?

- What credit score do I need for an energy plan?

- What if I fail a credit check?

- Electricity plans with no credit checks

- How to improve your credit score

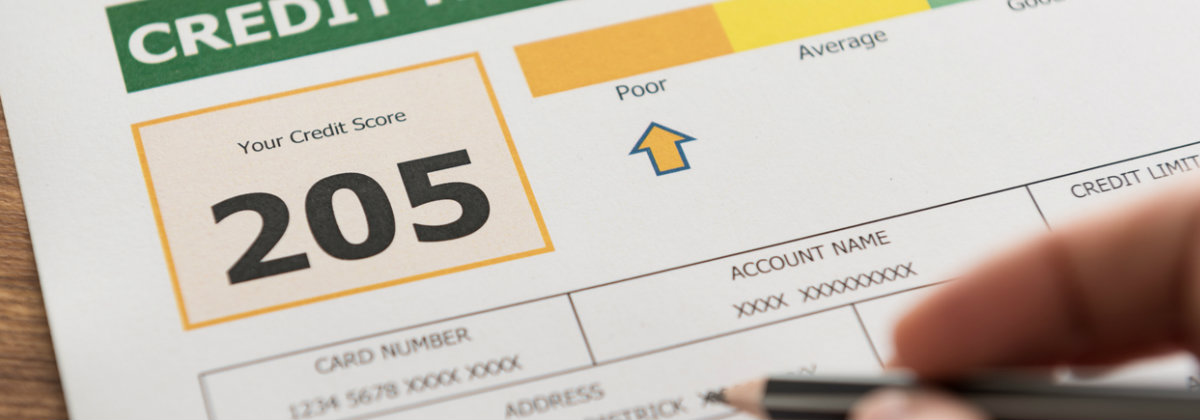

What is a credit score?

A credit score, also called a credit report, essentially determines how reliable a person is to repay their debts. Credit scores vary across different agencies, generally ranging from 0 to 1,200 or 0 to 1,100, with a higher number representing a better credit score.

One of the most common measurements, the Equifax score, operates on a five-point system ranging from below average to excellent.

- Excellent: 853 – 1200

- Very Good: 735 – 852

- Good: 661 – 734

- Average: 460 – 660

- Below Average: 0 – 459

Other notable credit reporting agencies include Experian and Illion. You can receive a free credit score once per year by contacting any of the below reporting agencies

- Equifax: 13 83 32

- Illion: 13 23 33

- Experian: 1300 783 684

All you need to receive your credit score is a few personal details and a valid form of ID. It will take 10 days to receive the results, but you can pay a small fee to receive it faster.

Check your credit score for free

Why do energy companies run credit checks?

As energy services are postpaid, customers are billed for electricity or gas after it’s used, not before. So if you’re signing up to a new electricity or gas provider for the first time, it’s likely your new retailer will run a credit check to determine your ability to pay bills on time.

Not all energy providers will perform checks, especially if you’re on a no-contract offer. You also won’t be subject to a new check just for adding or changing existing products with your current provider, or when moving house.

What credit information do energy retailers collect?

Energy retailers use credit agencies to obtain your credit information and build a risk assessment profile. This credit information includes:

-

-

- Identification information`

-

- Consumer credit liability information

- Repayment history information

- Past credit applications

- Default information

- Payment information

- New arrangement information

- Court proceeding history

- Personal insolvency information

- Credit infringement history

- Public information

With this information, the credit agency produces a ‘credit score’ which is then used by the energy retailer to determine your eligibility.

You won’t need to supply your energy provider with all of the above information: just give your retailer permission to check your credit history and they’ll take care of the rest. This is something you’ll need to agree to during the sign-up process by confirming that you have read and understood the retailer’s terms and conditions online.

What do energy companies do with credit information?

There are strict privacy rules regarding credit history checks. Energy retailers typically retain your credit information during the application process. After that, the retailer must take ‘reasonable steps’ to destroy credit information.

Your credit information can only be used to create a credit score to determine eligibility. Your personal history cannot be used for any other purpose. For example, an energy company absolutely cannot charge customers with bad credit history a different rate for electricity.

It’s also within your right to request access to the credit eligibility information that your energy company holds on you. Simply lodge a request by emailing or phoning your company.

Compare cheap electricity deals

Here are some of the cheapest published deals from the retailers on our database that include a link to the retailer’s website for further details. These are products from referral partners†. These costs are based on the Ausgrid network in Sydney but prices may vary depending on your circumstances. This comparison assumes general energy usage of 3900kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

Here are some of the cheapest published deals from the retailers on our database that include a link to the retailer’s website for further details. These are products from referral partners†. These costs are based on the Citipower network in Melbourne but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4000kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

Here are some of the cheapest published deals from the retailers on our database that include a link to the retailer’s website for further details. These are products from referral partners†. These costs are based on the Energex network in Brisbane but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4600kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

Here are some of the cheapest published deals from the retailers on our database that include a link to the retailer’s website for further details. These are products from referral partners†. These costs are based on the SA Power network in Adelaide but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4000kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

What credit score do I need for an energy plan?

Nearly every energy company in Australia reserves the right to check the credit scores of prospective customers. Retailers don’t publish their creditworthiness criteria for obvious commercial reasons, but the general attitude seems to be that they’re not particularly picky.

Unless you have a below-average credit score and an extensive history of default payments, then rest assured that an energy company probably won’t knock you back.

That said, a few electricity retailers appear more concerned than others about credit checks. Some market offers have explicit credit requirements outlined in their Basic Product Information Documents/Victorian Energy Price Fact Sheets under the ‘eligibility requirements’ section.

With this in mind, it seems reasonable to suggest that consumers with poor credit history could miss out on the cheapest energy deals.

What if I fail a credit check?

Credit history checks are used to determine a particular customer’s suitability for a market contract – so the good news is that even if you do fail a credit check, you have options.

If you want to change plans with your current energy provider, or you’re moving and looking to use the same retailer that serviced the property previously, that same retailer is legally obliged to give you access to a standing offer, regardless of your credit score.

However, if you intend to switch energy providers and fail a credit check, the new provider can choose to turn you away, no matter if it’s a market or standing offer you’re after. In this case, the retailer will usually advise that you contact your energy distributor (the network responsible for your supply) instead, as it can inform you which retailer is obligated to offer you a standing offer in its place.

If you struggle with managing constant bill shock and on-time payments, energy companies can also offer you a range of hardship assistance options, such as bill smoothing and payment plans.

Electricity plans with no credit checks

Prepaid electricity plans, which enable customers to prepay for their preferred amount of electricity, completely bypass the need for a credit check. This is an excellent option for customers with a poor credit score. At the time of writing, these are the retailers offering prepaid plans:

- Powershop in New South Wales, Victoria, South East Queensland and South Australia offers customers add-on, pre-paid ‘Powerpacks’ in addition to standard postpaid plans.

- Horizon Power in Western Australia.

- Jacana Energy in the Northern Territory (prepaid meters).

For postpaid plans, the vast majority of electricity/gas retailers will still conduct a credit check when taking on new customers. There’s a misconception that large companies like AGL, Origin and EnergyAustralia don’t take the time to credit check each new account, but the reality is that even the big three will have a look at your credit score as part of the sign-up process.

That being said, it’s unlikely your energy provider is monitoring your credit long-term. If you’re simply switching plans, it may not be worth your provider’s time and expense to assess your creditworthiness.

Of course, don’t just assume that your retailer won’t look into your credit history. If you have any concerns about a credit check, then ask the retailer about it before making any moves.

How to improve your credit score

To improve your credit score, you generally just need to prove some fiscal responsibility. You can improve your credit score by:

- Making rent and bill repayments on time

- Reducing credit card limits

- Consolidating debts

- Paying loans on time

- Paying off your credit card in full each month

If you’re struggling with existing debt, finding zero-cost ways to reduce your energy bills and maximising discounts offered by your existing provider (if any) can speed up paying off all your debt obligations.

If you’re looking for more information on credit scores in Australia, check out the following resources:

Original reporting by Simon Downes

Image Source: Shutterstock.com

Share this article