Compare Electricity Plans

Compare latest electricity plans and prices in Queensland.

We want to give you as much information as possible to help you make an informed decision about your next electricity provider. The improved competition in Queensland is certainly good news and seems to have put downward pressure on electricity prices.

But with the increased marketing and claims of big savings, finding the right power company for your needs has become a tougher challenge. That’s where our comparison can help as we have rated QLD electricity providers based on the real-world experiences of their customers. This year, more than 1,600 households have given us their views. Keep in mind that while our ratings include five of the most prominent electricity retailers in Queensland, you may find others operating in your area.

Canstar Blue surveyed 1,667 Queensland households for their feedback on their electricity retailer. Respondents had to live in Queensland, have an electricity account and pay the bills for their response to be eligible.

Respondents rate their satisfaction with their electricity provider from zero to 10, where zero is extremely dissatisfied and 10 is extremely satisfied. Provider satisfaction was rated by respondents on the following criteria:

The winning brand is the one that receives the highest overall satisfaction rating once all the scores from the overall satisfaction criteria are combined and averaged.

Brands must have received at least 30 responses to be included, so not all brands available in the market have been compared in this survey. The brands rated in this survey are listed below in order of best overall satisfaction.

Best QLD electricity providers:

Find more detailed information on our ratings methodology.

Here are some of the cheapest published deals from the retailers on our database that include a link to the retailer’s website for further details. These are products from referral partners†. These costs are based on the Energex network in Brisbane but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4600kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area and to see other products in our database that may be available. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

Here are some of the cheapest published deals from the retailers on our database that include a link to the retailer’s website for further details. These are products from referral partners†. These costs are based on the Energex network in Brisbane but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4600kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area and to see other products in our database that may be available. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision. The next three tabs feature products exclusively from AGL, EnergyAustralia and Origin.

Here are the AGL Energy plans on our database for SEQ. These are products from a referral partner†. These costs are based on the Energex energy network in Brisbane but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4600kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area and to see other products in our database that may be available. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

Here are the EnergyAustralia plans on our database for SEQ. These are products from a referral partner†. These costs are based on the Energex network in Brisbane but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4600kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area and to see other products in our database that may be available. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

Here are the Origin Energy plans on our database for SEQ. These are products from a referral partner†. These costs are based on the Energex network in Brisbane but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4600kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area and to see other products in our database that may be available. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

Red Energy managed to take out five-star reviews for its overall satisfaction, value for money, customer service, bill and cost clarity and ease of sign-up. It received four stars for online tools and advice.

Red Energy made a good impression on QLD households in the last year, stealing the top spot in yet another state, after years of domination in our New South Wales electricity ratings. Red Energy’s big selling point is its partnership with Qantas which sees customers collect Frequent Flyer points for money spent on energy.

The retailer is also one of few providers to supply electricity and gas in the state, alongside Alinta Energy, AGL and Origin. Owned by the renewable generation company, Snowy Hydro, Red Energy has earned a solid reputation for good customer service, reflected by its continued success in our NSW electricity ratings.

Here are Red Energy’s plans on our database for SEQ. These are products from a referral partner†. These costs are based on the Energex network in Brisbane but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4600kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

This year, Alinta Energy scored four stars across the board for overall satisfaction, value for money, customer service, bill and cost clarity, online tools and advice and ease of sign-up.

Alinta Energy is one of the biggest electricity and gas suppliers in the southern states of Australia and one of the biggest gas retailers in Western Australia. Alinta Energy keeps things relatively simple with just one or two market offers in each state that it serves. Its electricity plans previously came with significant discounts on usage charges but now focus instead on lower rates and no discounts. There are no lock-in contracts or exit fees on Alinta’s deals and all rates are variable. Alinta also offers gas in the state for those who need a dual fuel supply, and a solar-specific plan for those with qualifying solar panels.

Here are the Alinta Energy plans on our database for SEQ. These are products from a referral partner†. These costs are based on the Energex network in Brisbane but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4600kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

Origin Energy scored four stars for overall satisfaction, customer service, bill and cost clarity and ease of sign-up. It scored three stars for value for money but a notable five stars for online tools and advice.

Origin Energy promotes a few market offers with competitive rates. Its flagship offer holds a modest amount off the reference price and comes with a 12-month benefit period. Another plan allows customers to earn Everyday Rewards points. For those who wish to set and forget, Origin Basic is the retailer’s most simple plan, which has the same rates as the reference price in South East Queensland. As one of Australia’s leading solar retailers, Origin also has two specific plans for customers who own solar panels.

Here are the Origin Energy plans on our database for SE QLD. These are products from a referral partner†. These costs are based on the Energex network in Brisbane but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4600kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

AGL scored three stars across the majority of research categories this year, aside from online tools and advice where it earned a notable four stars.

AGL typically brings one or two market offers to the table in SEQ, with varying benefits and conditions based on personal preferences. The plans come with variable rates and encourage the use of e-billing. There are no exit fees on any of AGL’s plans in QLD and for customers with a rooftop PV system, the retailer also has a solar deal. Additionally, AGL offers a discounted plan for customers who hold a Seniors Card.

Here are the AGL Energy plans on our database for SE QLD. These are products from a referral partner†. These costs are based on the Energex energy network in Brisbane but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4600kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

EnergyAustralia scored three stars for overall satisfaction this year, as well as value for money, customer service, bill and cost clarity, online tools and advice and ease of sign-up.

EnergyAustralia has a few offers for Queenslanders to choose from with varying contract terms and benefits available. Customers with solar panels may also be eligible for its solar specific offering, which could see them earning a higher feed-in tariff on their exports. There are also no exit fees or lock-in contracts across any of EnergyAustralia’s electricity deals in QLD.

Here are the EnergyAustralia plans on our database for SE QLD. These are products from referral partners†. These costs are based on the Energex network in Brisbane but prices may vary depending on your circumstances. This comparison assumes general energy usage of 4600kWh/year for a residential customer on a single rate tariff. Please use our comparison tool for a specific comparison in your area. Our database may not cover all deals in your area. As always, check all details of any plan directly with the retailer before making a purchase decision.

Picking a new electricity provider is not a simple decision, but the good news is that most companies offer plans with no contract agreements – or at least no exit fees – meaning you can easily switch if things don’t work out as you had hoped.

Our customer reviews offer a helpful insight into how existing customers rate the biggest operators in SEQ – and our database shows where you can find the cheapest rates in the Brisbane area – but you will only really know an energy company once you have signed up to it. To help you with your search, however, here are some quick things to consider before signing up:

All power companies are required by law to publish energy price fact sheets for each of their products, where you will be able to find the answers to these questions. And if you can’t find what you are looking for, don’t be afraid to pick up the phone and discuss your queries with the retailer directly .

As an energy customer, you have consumer rights, so if you’re not happy with your existing agreement, make sure you contact your retailer and seek a resolution. If you decide to switch providers, you have a 10-day cooling-off period to change your mind without incurring any fees. When comparing offers, be sure to check the costs you’ll be charged and keep our customer ratings in mind. ‘Cheapest’ doesn’t automatically mean the ‘best’, but for a helpful guide on power prices in Brisbane and the surrounding areas, consult our dedicated QLD electricity cost comparison report.

While it’s hard to pinpoint the cheapest retailer at any one time, it’s fair to say that the likes of GloBird Energy and OVO Energy are consistently at the top of the tables for cheap prices.

Although price is arguably the biggest influence on choosing your next provider, it’s important not to overlook other features of a power retailer. This includes customer service, value-add incentives, rewards programs and discounts to help you find the best value plan. Keep price in mind, but always review brands on other factors that offer value elsewhere, as this will help separate the average deals from the great.

The three largest residential electricity providers in all of QLD are AGL, Ergon Energy and Origin Energy. AGL has the largest market share in QLD with 17.7%, while Ergon Energy accounts for 29.8% (regional QLD) and Origin Energy has 27.0%. Following these electricity retailers are Alinta Energy (9.5%), EnergyAustralia (4.4%) and Red Energy (3.4%).

Note: Ergon Energy is the presiding energy provider in regional QLD.

Here is a list of electricity retailers and their residential market share in South East Queensland on the Energex network:

Source: the above figures have been sourced from the Australian Energy Regulator (AER) Retail Energy Market Performance Update for Quarter 2, 2024-25.

According to the AER, Origin Energy is the largest natural gas supplier in QLD, holding 44.1% of the residential market, followed by AGL with 37.6% and Alinta Energy at 8.1%. Trailing behind is Metered Energy at 4.4%, while Red Energy has 4.1% and GloBird Energy has 1.3% market share.

For small business electricity, it’s Origin Energy who dominates in QLD, representing 24.4% of the local market. Next in line is AGL (12.9%), EnergyAustralia (4.0%) and Alinta Energy (3.9%).

In our latest annual review of QLD energy providers, we asked more than 1,660 Queenslanders questions to better understand what’s important to them. Here’s what we found:

It shouldn’t take any longer than two business days for your electricity account to be switched over to your new provider. Your old electricity provider will have around 48 hours to finalise your account using an estimated bill, before sending your details to your new provider.

Once your account has been successfully transferred into your new company’s hands, you’ll usually receive a confirmation email or letter. But, don’t forget you’ll need to settle any outstanding bills from your previous provider.

Katrina Hasdell is an Energy Content Producer at Canstar Blue, where she covers Australia’s retail energy market. Katrina is dedicated to providing consumers with easy-to-read information on their energy options so they can get better deals on electricity, solar power and more.

You can follow Katrina on LinkedIn.

Samantha Mauro-Todd is Canstar Blue’s Consumer Research Specialist, coordinating the consumer research program behind our customer satisfaction awards across Canstar and Canstar Blue in Australia and New Zealand. Sam has earned a Bachelor of Business (Marketing) from Griffith University and, with seven years in market research and two years in marketing, she is experienced in survey design, implementation and analysis, coupled with an understanding of marketing principles and best practice.

The list below features all the electricity providers that currently list plans in SEQ, according to our database.

Canstar Blue’s electricity comparison service includes pricing from all these providers. These companies only operate in SEQ. Ergon Energy is the main electricity retailer in regional QLD. Please note that there may be other providers operating in your area.

Most plans in Queensland come with a feed-in tariff for solar customers. However, the feed-in tariffs in QLD can vary dramatically between providers. The good news is that retailers are competing to offer the most favourable rates possible. This means various solar-specific plans for Queenslanders and feed-in tariffs of up to 12c per kWh.

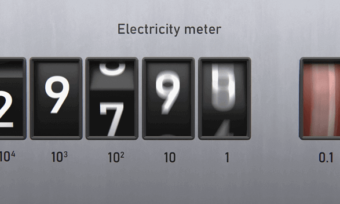

In addition to a growing number of products, households in SEQ can also consider several tariff options that may better suit their usage habits. An electricity tariff relates to the pricing structure of an energy plan. All power plans have a fixed daily charge for the supply of power to the premises, but the rates that you pay for usage can vary significantly depending on when you use power. The two primary tariffs in Queensland are known as single rate and time of use.

A single rate tariff means households are charged the same amount for electricity whatever time of day they happen to use it, while time of use tariffs can have multiple prices depending on when you use power. Time of use tariffs come with ‘peak’ and ‘off-peak’ rates – with electricity more expensive during periods of high demand – as well as ‘shoulder’ rates for times in between. While single rate tariffs can be used with any type of energy meter, households will need a smart meter or interval meter to access a time of use tariff.

Other tariffs available in QLD include a variety of demand and controlled load tariffs.

To find out which tariff may be right for you, you first need to understand the different pricing structures. Switching to a time of use tariff and still using lots of power when prices are highest in the early evening could prove a financially costly mistake.

It is also important to remember that prices in SEQ are set by the retailers, with those in regional areas set by the Queensland Competition Authority (QCA).

The Queensland Government provides power concessions for eligible seniors and pensioners. The Electricity Rebate could knock as much as $372 off an eligible customer’s annual power bill. Concessions may also be available for Health Care Card holders. Contact your retailer for details.

When it comes to electricity, QLD is split into two different geographical areas: South East Queensland and regional and far north Queensland.

In SEQ, electricity prices are deregulated, meaning retailers set their own plans and prices, with consumers in places such as Brisbane, Ipswich, Toowoomba, the Gold Coast and Sunshine Coast able to switch to retail market offers from more than 20 different companies. However, some SEQ households remain on standard electricity contracts and are therefore likely to be paying more than they need to. If you live in these areas and still have a default energy contract, you should contact your provider and ask about your options.

In regional areas of QLD, prices remain regulated by the Queensland Competition Authority and while households can technically pick their provider in some instances, the lack of retail competition leaves Ergon Energy as the default retailer in places like Bundaberg, Rockhampton, Townsville, Cairns, Mount Isa and other regional areas in between. Customers in these areas are still on regulated contracts, with the terms and conditions set out by law. Electricity costs in regional QLD however, are subsidised by the state government to ensure households do not end up paying considerably more than those in SEQ.

SEQ is covered by the Energex electricity network, while most of regional QLD is on the Ergon network. However, a small area around southern QLD is just on the NSW border and falls onto the Essential Energy network, which covers huge parts of rural NSW.

This report talks about the reference price for energy, but what exactly is it? In July 2019, tough new industry regulations took effect designed to simplify power plans and the way consumers compare. Part of the change was that a new, cheaper Default Market Offer (DMO) was introduced which meant customers on expensive standing offers automatically switched to the cheaper tariff. This resulted in notable savings for these customers, but the DMO also now acts as a reference point from which all products must be compared. The reference price is consistent across all retailers, so you can be sure that the percentage savings referenced (either more than, equal to or less than the reference price) genuinely indicate the true value of a plan, as opposed to the previous way of doing things whereby discounts were applied to different base rates.

In 2016 the state government also decided to merge its two electricity distributors – Ergon Energy and Energex. So, in addition to providing retail services throughout regional QLD, Ergon Energy is also the energy distributor, meaning it is responsible for managing and improving the vast network infrastructure that delivers power to homes and businesses. Energex is the electricity distributor for SEQ. The state-owned companies have been brought together under parent company Energy Queensland, based in Townsville.

The Queensland Government continues to play an integral role in the generation of electricity in the state. It owns a wealth of coal-fired and gas turbine power stations scattered across QLD, plus hydroelectric stations and solar and wind farms.

Here are the previous winners of Canstar Blue’s Electricity Providers – QLD Customer Satisfaction Award:

Best-Rated Electricity Providers for Business - July 11th

What’s the average electricity bill in Australia? Canstar Blue breaks down household energy costs by state, capital city and household size.

– Read more

Best-Rated Electricity Providers NSW - June 26th

Looking to save on your monthly power bill? In this article, Canstar Blue compares single rate vs time of use energy tariffs.

– Read more

Best-Rated Electricity Providers NSW - June 20th

Canstar Blue reviews energy offers from retailers including Origin Energy, Engie, Alinta Energy and Red Energy.

– Read more

Best Solar Electricity Providers - June 3rd

Which solar provider offers the best solar Feed-in Tariff? In this article, Canstar Blue compares solar FiTs in each state.

– Read more

Best-Rated Electricity Providers for Business - May 1st

Canstar Blue has calculated the average electricity cost per kWh across Australia. Learn more about kWh costs in this guide.

– Read more*NSW, QLD and SA: Price is GST inclusive and is: The estimated lowest possible price a representative customer would be charged in a year for this plan, assuming all conditions of discounts offered (if any) have been met, based on the AER’s model annual usage in the distribution region as stated at the top of each table.

~VIC: Price is GST inclusive and is: The estimated lowest possible price a customer would be charged in a year for this plan, using the Victorian Government’s annual reference consumption for domestic customers in your distribution region as stated at the top of each table and assuming all conditions of discounts offered (if any) have been met.

ACT: Price is GST inclusive and is: The estimated lowest possible price a representative customer would be charged in a year for this plan, using the Independent Competition and Regulatory Commission (ICRC) annual reference consumption for domestic customers in your distribution region as stated at the top of each table and assuming all conditions of discounts offered (if any) have been met.

TAS: The price shown is inclusive of GST and is the estimated lowest possible price a representative customer would be charged in a year for this plan, assuming all conditions of discounts offered, if any, have been met. The general usage for products displayed in the table for Tasmanian postcodes is based on the median electricity usage of customers in Tasmania. The median usages are: 2,947 kWh/year for a Single Rate tariff, and 7,428 kWh/year for a Single Rate + Controlled Load tariff. These usage assumptions are based on the latest Typical Electricity Customers in Tasmania report released by the Office of the Tasmanian Economic Regulator. If the amount of electricity you actually use differs greatly from this estimate, your bill could be significantly larger or smaller than the charges listed for each plan.

Some plans may require you to meet certain conditions before a discount may become available to you. Check the energy provider’s plan information for details of all possible discounts that may apply and any conditions that need to be met to be eligible for these discounts. Some plans may have a minimum term longer than one year. In that case the total cost over the term will be much higher than the price (which is only for one year). Consider the provider’s detailed product and pricing information before making a decision to take out a new plan or switch electricity providers.

^What is the Reference Price?

The reference price is set by the Australian Energy Regulator (AER) for a financial year in relation to electricity supply to residential customers in the distribution region and is based on an assumed annual usage amount. Any difference between the reference price and the unconditional price of a plan is expressed as a percentage more or less than the reference price. The terms of any conditional discounts are shown, along with any further difference between the reference price and the discount applied if a condition is met, expressed as a percentage more or less than the reference price.

>What is the VDO?

The Victorian Default Offer (VDO) includes a daily supply charge and usage charges (per kilowatt hour). Differences in tariffs across distribution regions reflect the unique costs of providing electricity services in each area. The difference between the VDO and the unconditional price of a plan, based on the Victorian Government’s annual reference consumption for domestic customers in the distribution region, is expressed as a percentage more or less than the VDO. The terms of any conditional discounts are shown, along with any further difference between the VDO and the discount applied if a condition is met, expressed as a percentage more or less than the VDO.

Solar Products:

Annual cost estimates exclude solar payments. Feed-in tariffs shown are single rate only. Solar products may only be available to solar customers and some products may only be available to customers who purchase solar PV or other products through the retailer.

Referral Partners

†By clicking on a brand, 'go to site', 'shop online', 'get quotes now', or 'see offer' button, you will leave Canstar Blue and be taken to our referral partner to compare. Canstar Blue may be paid for this referral. You agree that Canstar Blue’s terms and conditions apply to this referral. Please note that references to an 'offer' do not mean that you will automatically be accepted or eligible for a product, eligibility requirements may apply.

Canstar Blue may earn a fee for referrals from its website tables, and from sponsorship of certain products. Fees payable by product providers for referrals and sponsorship may vary between providers, website position, and revenue model. Sponsorship fees may be higher than referral fees. Sponsored products are clearly disclosed as such on website pages. They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Sponsored products may be displayed in a fixed position in a table, regardless of the product's rating, price or other attributes. The table position of a Sponsored product does not indicate any ranking or rating by Canstar. The table position of a Sponsored product does not change when a consumer changes the sort order of the table. For more information please see How Are We Funded.